BeiGene Enters Next Phase of Global Growth with Announcement of Second Quarter 2024 Financial Results and Corporate Updates

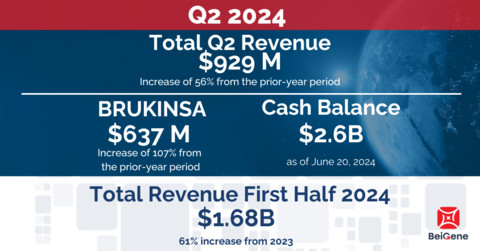

Generated total revenues of $929 million, an increase of 56% from the prior-year period; reduced GAAP operating loss and achieved non-GAAP operating income

Strengthened hematology leadership with global BRUKINSA revenues of $637 million, an increase of 107% from the prior-year period; advanced pivotal programs for BCL2 inhibitor sonrotoclax and BTK-targeted degrader BGB-16673

Advanced innovative solid tumor pipeline of more than 15 investigational molecules, including ADCs, multispecific antibodies, and targeted therapies for lung, breast, and gastrointestinal cancers

Strengthened global presence with opening of $800 million, 42-acre flagship U.S. biologics manufacturing facility and clinical R&D center in New Jersey and proposal to redomicile from Cayman Islands to Switzerland, an innovative biotech ecosystem for life sciences leaders and institutions

(Graphic: Business Wire)

SAN MATEO, Calif.--(뉴스와이어)--BeiGene, Ltd. (NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global oncology company, today announced results from the second quarter 2024 and corporate updates that strengthen the Company for future global growth.

“This was a tremendous second quarter and an inflection point as BeiGene achieved positive non-GAAP operating income with rapidly increasing global revenues and continued financial discipline. Having now reached this milestone, we will further build on our differentiated, strategic capabilities as a leading, global oncology innovator,” said John V. Oyler, Co-Founder, Chairman and CEO of BeiGene. “BRUKINSA is emerging as the BTKi class leader in the U.S. in new patient starts across all approved indications, demonstrating the strength of its clinical efficacy and safety data, and is the only BTKi to demonstrate superior efficacy versus ibrutinib in a head-to-head trial. With our leadership in hematology, we are working to expand into other highly prevalent cancer types, backed by one of the largest oncology research teams in the industry. With our continued growth in established biopharmaceutical hubs such as New Jersey and Switzerland, we are better positioned to reach even more patients with our innovative medicines.”

Financial Highlights

(Amounts in thousands of U.S. dollars)

(To view the table, please visit https://www.businesswire.com/news/home/20240807337131/en/)

Key Business Updates

BRUKINSA® (zanubrutinib)

· U.S. sales of BRUKINSA totaled $479 million in the second quarter of 2024, representing growth of 114% over the prior-year period, with more than 60% of the quarter over quarter demand growth coming from expanded use in CLL as BRUKINSA continued to gain share in CLL new patient starts; BRUKINSA sales in Europe totaled $81 million in the second quarter of 2024, representing growth of 209%, driven by increased market share across all major markets, including Germany, Italy, Spain, France and the UK;

· Presented data from Arm D of the Phase 3 SEQUOIA trial evaluating BRUKINSA in combination with venetoclax in treatment-naïve (TN) patients with high-risk CLL and/or small lymphocytic lymphoma (SLL) with del(17p) and/or TP53 mutation as an oral presentation at the European Hematology Association (EHA) 2024 Hybrid Congress; preliminary data demonstrated an overall response rate of 100% in 65 response-evaluable patients and a rate of complete response (CR) plus CR with incomplete hematopoietic recovery (CRi) of 48%; and

· Presented new analyses highlighting improved progression free survival and response rates and a low usage of antihypertensive medicines for patients treated with BRUKINSA compared to other Bruton’s tyrosine kinase inhibitors (BTKis) used to treat CLL/SLL, including acalabrutinib and ibrutinib at the American Society of Clinical Oncology (ASCO) Annual Meeting and EHA.

TEVIMBRA® (tislelizumab)

· Sales of tislelizumab totaled $158 million in the second quarter of 2024, representing growth of 6% compared to the prior-year period;

· Presented new data from the Phase 3 RATIONALE-306 study evaluating TEVIMBRA plus chemotherapy in patients with advanced or metastatic esophageal squamous cell carcinoma (ESCC) at ASCO; and

· Received an update that the U.S. Food and Drug Administration (FDA) has deferred approval for tislelizumab in first-line unresectable, recurrent, locally advanced, or metastatic ESCC with a target PDUFA action date of July 2024 on account of a delay in scheduling clinical site inspections.

Key Pipeline Highlights

Hematology

Sonrotoclax (BCL2 inhibitor)

· More than 1,000 patients enrolled to date across the program;

· Completed enrollment in global Phase 2 trial in R/R mantle cell lymphoma (MCL) and continued enrollment in global Phase 2 trial in Waldenström’s macroglobulinemia (WM) and China-only Phase 2 trial in R/R CLL, all with registrational intent, as well as continued enrollment in global Phase 3 CELESTIAL trial in combination with BRUKINSA in TN CLL;

· At EHA 2024, presented data highlighting deep and durable responses with tolerable safety profile in Phase 1 studies in combination with BRUKINSA in R/R CLL/SLL and R/R MCL as well as results of additional Phase 1 trials demonstrating encouraging response rates, durable responses and manageable safety profiles as monotherapy in R/R WM, in combination with azacitidine in both TN and R/R acute myeloid leukemia, and in combination with dexamethasone in R/R multiple myeloma harboring translocation (11;14);

· Received FDA fast track designation for R/R WM; and

· Anticipating first subjects enrolled in Phase 3 programs in R/R CLL and R/R MCL in the fourth quarter of 2024 or first quarter of 2025.

BGB-16673 (BTK CDAC)

· More than 300 patients enrolled to date across the program; continued to enroll potentially registration enabling expansion cohorts in R/R MCL and R/R CLL; and

· At EHA 2024, presented data highlighting promising preliminary efficacy and safety in patients with R/R CLL/SLL; anticipating first subject enrolled in Phase 3 program in fourth quarter of 2024 or first quarter of 2025.

Solid Tumors

Lung Cancer

· Multiple randomized tislelizumab lung cancer combination cohorts with BGB-A445 (anti-OX40), LBL-007 (anti-LAG3) and BGB-15025 (HPK1 inhibitor) expected to read out in 2024;

· BGB-C354 (B7H3 ADC): Initiated dose escalation for the Company’s first internally developed ADC;

· BGB-R046 (IL-15 prodrug): Initiated dose escalation; this is a cytokine prodrug, leveraging protease-dependent release of active IL-15 in the tumor microenvironment and eliciting anti-tumor activity by promoting T and natural killer (NK) cell expansion; and

· Pan-KRAS, MTA-cooperative PRMT5 inhibitors and EGFR CDAC targeted protein degrader on track to enter the clinic in the second half of 2024.

Breast and Gynecologic Cancers

· BGB-43395 (CDK4 inhibitor): Continued dose escalation in monotherapy and in combination with fulvestrant and letrozole in the anticipated efficacious dose range with no dose limiting toxicities observed; more than 60 patients enrolled to date across the program; potential to share first readout of Phase 1 data in the fourth quarter of 2024; and

· BG-68501 (CDK2 inhibitor) and BG-C9074 (B7H4 ADC): Continued monotherapy dose escalation, with pharmacokinetics as expected and no dose limiting toxicities observed.

Gastrointestinal Cancers

· Tislelizumab combination cohorts with LBL-007 (anti-LAG3) in ESCC reading out in 2024;

· BLA accepted by the NMPA for zanidatamab for the treatment of second-line biliary tract cancer; and

· CEA ADC, FGFR2b ADC and GPC3x4-1BB bispecific antibody on track to enter the clinic in the second half of 2024.

Immunology & Inflammation

· Initiated clinical development of BGB-43035 (IRAK4 CDAC) with potential to induce deeper and faster IRAK4 degradation with stronger cytokine inhibition than competitors; this is the second targeted degrader from the Company’s proprietary CDAC platform.

Corporate Updates

· Opened flagship U.S. biologics manufacturing facility and clinical R&D center at the Princeton West Innovation Campus in Hopewell, N.J.; the facility includes 400,000 square feet of dedicated manufacturing space; and

· Announced intent to change jurisdiction of incorporation from the Cayman Islands to Basel, Switzerland, enabling the Company to deepen its roots in a global biopharmaceutical hub as it further executes on its global growth strategy to reach more patients around the world with its innovative medicines; this redomiciliation is subject to shareholder approval.

Second Quarter 2024 Financial Highlights

Revenue for the three months ended June 30, 2024, was $929 million, compared to $595 million in the same period of 2023, driven primarily by growth in BRUKINSA product sales in the U.S. and Europe of 114% and 209% respectively.

Product Revenue for the three months ended June 30, 2024, was $921 million, compared to $554 million in the same period of 2023, representing an increase of 66%. The increase in product revenue was primarily attributable to increased sales of BRUKINSA. For the three months ended June 30, 2024, the U.S. was the Company’s largest market, with product revenue of $479 million, compared to $224 million in the prior year period. In addition to BRUKINSA revenue growth, product revenues were positively impacted by sales of in-licensed products from Amgen in China and tislelizumab.

Gross Margin as a percentage of global product revenue for the second quarter of 2024 was 85%, compared to 83% in the prior-year period. The gross margin percentage increased primarily due to proportionally higher sales mix of global BRUKINSA compared to other products in the portfolio.

Operating Expenses

The following table summarizes operating expenses for the second quarter 2024 and 2023, respectively:

(To view the table, please visit https://www.businesswire.com/news/home/20240807337131/en/)

Research and Development (R&D) Expenses increased for the second quarter of 2024 compared to the prior-year period on both a GAAP and adjusted basis primarily due to advancing preclinical programs into the clinic and early clinical programs into late stage. Upfront fees and milestone payments related to in-process R&D for in-licensed assets totaled $12 million in the second quarter of 2024, compared to nil in the prior-year period.

Selling, General and Administrative (SG&A) Expenses increased for the second quarter of 2024 compared to the prior-year period on both a GAAP and adjusted basis due to continued investment in the global commercial launch of BRUKINSA, primarily in the U.S. and Europe. SG&A expenses as a percentage of product sales were 48% for the second quarter of 2024 compared to 71% in the prior year period.

Income (Loss) from Operations in the second quarter of 2024 operating loss decreased 66% on a GAAP basis. On an adjusted basis, we achieved operating income of $48 million. The decrease in GAAP operating loss and achievement of profitability on an adjusted basis is a key strategic goal and the result of tremendous efforts to drive growth while maintaining investment discipline.

GAAP Net Loss improved for the quarter ended June 30, 2024, compared to the prior-year period, as our product revenue growth and management of expenses is driving increased operating leverage.

For the quarter ended June 30, 2024, net loss per share were $(0.09) and $(1.15) per American Depositary Share (ADS), compared to $(0.28) per share and $(3.64) per ADS in the prior year period.

Cash Used in Operations for the quarter ended June 30, 2024, totaled $96 million compared to $294 million in the prior-year period, driven by improved operating leverage.

For further details on BeiGene’s Second Quarter 2024 Financial Statements, please see BeiGene’s Quarterly Report on Form 10-Q for the second quarter of 2024 filed with the U.S. Securities and Exchange Commission.

About BeiGene

BeiGene is a global oncology company that is discovering and developing innovative treatments that are more affordable and accessible to cancer patients worldwide. With a broad portfolio, we are expediting development of our diverse pipeline of novel therapeutics through our internal capabilities and collaborations. We are committed to radically improving access to medicines for far more patients who need them. Our growing global team of more than 10,000 colleagues spans five continents. To learn more about BeiGene, please visit www.beigene.com and follow us on LinkedIn, X (formerly known as Twitter) and Facebook.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding BeiGene’s potential to further emerge as a leading, global oncology innovator; BeiGene’s ability to expand into other highly prevalent cancer types; BeiGene’s preliminary clinical data and activities, as well as anticipated read outs; whether shareholders will approve BeiGene’s change in jurisdiction of incorporation and if approved, whether this change will enable BeiGene to further execute on its global growth strategy; and BeiGene’s plans, commitments, aspirations and goals under the caption “About BeiGene”. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including BeiGene’s ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; BeiGene’s ability to achieve commercial success for its marketed medicines and drug candidates, if approved; BeiGene’s ability to obtain and maintain protection of intellectual property for its medicines and technology; BeiGene’s reliance on third parties to conduct drug development, manufacturing, commercialization, and other services; BeiGene’s limited experience in obtaining regulatory approvals and commercializing pharmaceutical products; BeiGene’s ability to obtain additional funding for operations and to complete the development of its drug candidates and achieve and maintain profitability; and those risks more fully discussed in the section entitled “Risk Factors” in BeiGene’s most recent quarterly report on Form 10-Q, as well as discussions of potential risks, uncertainties, and other important factors in BeiGene’s subsequent filings with the U.S. Securities and Exchange Commission. All information in this press release is as of the date of this press release, and BeiGene undertakes no duty to update such information unless required by law.

Condensed Consolidated Statements of Operations (U.S. GAAP)

(Amounts in thousands of U.S. dollars, except for shares, American Depositary Shares (ADSs), per share and per ADS data)

(To view the table, please visit https://www.businesswire.com/news/home/20240807337131/en/)

Select Condensed Consolidated Balance Sheet Data (U.S. GAAP)

(Amounts in thousands of U.S. Dollars)

(To view the table, please visit https://www.businesswire.com/news/home/20240807337131/en/)

Note Regarding Use of Non-GAAP Financial Measures

BeiGene provides certain non-GAAP financial measures, including Adjusted Operating Expenses and Adjusted Operating Loss and certain other non-GAAP income statement line items, each of which include adjustments to GAAP figures. These non-GAAP financial measures are intended to provide additional information on BeiGene’s operating performance. Adjustments to BeiGene’s GAAP figures exclude, as applicable, non-cash items such as share-based compensation, depreciation and amortization. Certain other special items or substantive events may also be included in the non-GAAP adjustments periodically when their magnitude is significant within the periods incurred. BeiGene maintains an established non-GAAP policy that guides the determination of what costs will be excluded in non-GAAP financial measures and the related protocols, controls and approval with respect to the use of such measures. BeiGene believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of BeiGene’s operating performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of the Company’s historical and expected financial results and trends and to facilitate comparisons between periods and with respect to projected information. In addition, these non-GAAP financial measures are among the indicators BeiGene’s management uses for planning and forecasting purposes and measuring the Company’s performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(in thousands, except per share amounts)

(unaudited)

(To view the table, please visit https://www.businesswire.com/news/home/20240807337131/en/)

View source version on businesswire.com: https://www.businesswire.com/news/home/20240807337131/en/